The Newsletter You Didn't Subscribe To - Sloths

Your daily dose of nonsense to start the day with - 10 July 2020

Copyright shutterstock.com

Source: Suzi Eszterhas at www.suzieszterhas.com

Source: Sam Trull/The Sloth Institute Costa Rica

Coinbase considers direct listing

Coinbase, the cryptocurrency exchange, is exploring its options to publicly list its shares. Reuters reports that they are likely to directly list. According to its website, it has 35m+ users, with $7b of assets in custody.

Some people say that the traditional initial public offering leaves too much money on the table. An example would be the fintech insurance company, Lemonade (the same one I wrote about briefly here). On its IPO day, its share price closed at +138%. If you were the original pre-IPO shareholder, that means you have only sold your lot at 42% of the price that the market will take at close. On top of that, you paid top dollar to bankers whose job it is to find you the best price you can comfortably sell your shares at the liquidity required. Obviously you would feel the buyer’s remorse of going down the IPO route.

Of course, the bankers who did your IPO would probably argue that they take the financial risk if the IPO flops, as well as the reputational risk for underwriting a perceived flop.

But just in case you are a founder of a pre-IPO startup and you are worried about the risks of public listing, in today’s world you have another choice at the other end of the spectrum - you have entities like Bill Ackman’s shiny and brand new Pershing Square Tontine Holdings whose entire premise of existence is to take up all the public listing risk from the founders (and existing shareholders) by buying pre-IPO companies outright, then doing its magic before spitting it out to the public. IPO bankers would have to work harder now with this little extra competition.

But given Coinbase is after all a platform for what are essentially public auctions, maybe it’s not inconceivable for it to go down the Google route and auction its own shares?

Geography

Eons ago while visiting the Tate Modern, I came across this one exhibit:

What was most prominent about it, to me, was not what it had, but rather what it didn’t have. New Zealand is missing.

Well, this newsletter isn’t going to do that. Here are a couple of interesting facts about New Zealand.

New Zealand (I)

In today’s interpretation of central banking, inflation is the economy’s way of becoming swole. In today’s world, we are probably in a deflationary period and the governments are pumping in steroids to try to get inflation up.

But we haven’t always been in this slump. There was at one point where many places in the world were getting too swole too quickly - and this is bad too. The idea then is that there is an in-between rate that is optimal and that we should aim to achieve this optimal rate. This is called inflation targeting.

New Zealand was the first country to adopt inflation targeting as in 1989. New Zealand had high inflation (about 7% in 1989) and they were trying to bring it down to a range between 0% to 2%. According to this NPR podcast, Arthur Grimes was the dude who proposed this idea. He even had a catch phrase for it - “0 to 2 by ‘92”.

It was by no means easy and the labour unions definitely didn’t like it one bit (Ever tried interrupting someone mid set in a gym?). Unemployment did shoot up to about 11% during these years, and it looked to be pretty persistent, as shown in the chart below:

Source: Stats NZ

But did they achieve the inflation target that they wanted? Yes, they did. The graph below shows the Annual CPI inflation (target range shaded):

Source: Reserve Bank of New Zealand

For better or for worse, many governments today use inflation targeting - the UK targets 2%; the US targets 2%; Indonesia’s is 2% to 4%; the European Central Bank’s is also 2%, etc.

So there you have it. The world that we live in today is very much defined by what they New Zealanders have pioneered, for better or worse.

New Zealand (II)

Wine is a very important export for New Zealand, and the Americans are drinking a lot of it. According to this US Department of Agriculture report, the USA is the top import destination for NZ wine in 2017, 2018 and 2019:

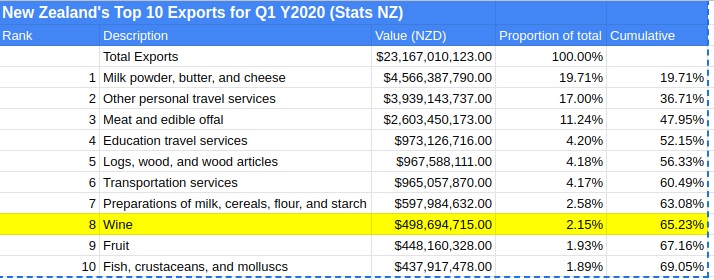

In the first quarter of 2020, wine was the 8th most exported category, representing 2.15% of total exports by value:

Souce: Stat NZ

And if you’re wondering where are the top wine producing regions, here’s the list compiled by the NZ wine trade association:

The bonkers world of finance

Here is a Reuters Breakingviews write up about the current state of affairs in the world of finance. One can say that it’s cynical and over the top, but I like it and it’s entertaining at the very least.

Here’s a summary:

You now pay to lend money (negative yields on a lot of bonds);

Value investing is dead;

Venture capital pumps money into unicorns with mystical valuations and even more mystical business models;

The two rules of private equity are “leverage, leverage, leverage” and “refinance!”

To be fair though, many private equity firms have diversified into properties and direct lending as more client money is turning away from negative yielding bonds into investments that are marketed as alternative investments that generate a (relatively) reasonable income. So it’s not like people are not doing anything to respond to this bonkers world.

Sloths