Relationship between international trade and the USA's wealth inequality?; Commerce finds a way?; What's Japan doing nowadays?

Your dose of nonsense - Monday, 2021-03-15

If you liked this, consider liking, subscribing and forwarding. You know, for the algos. If you didn’t like it, consider forwarding it to someone you don’t like.

Source: u/MahmoudAlrais on Reddit

Is there a relationship between international trade data and the USA's wealth inequality?

I really don’t know. I think this is a pretty hard topic to write about without being drawn into rhetoric on either side of this debate.

But here’s are the operating assumptions that I am making:

The official stance of the Trump administration on international trade was “America First”;

The official stance of the current Biden administration on international trade is “Buy American”, which even if it isn’t the same “America First”, rhymes like it.

So at least in a US-specific, mainstream Right vs Left debate, I don’t think I’m going to step on any toes there. But I’m probably going to leave a bitter taste on both sides of the “anti-globalisation” vs “free movement of goods, capital and labour” debate.

Anyway, last week, I left off with a chart showing that the proportion of net worth that the bottom 50% of the US population started declining in the 90’s, and I also left off with the question “who is to blame for this?”.

If increased wealth inequality in the US was a result of the financial crisis of 2008, we wouldn’t necessarily expect inequality to start increasing during the 90’s. This suggests that there is something else at play here.

Next on the list of “things people point the finger at” would be globalisation. And I suggested that it would be too convenient to blame everything on China. I suggested that if outsourcing jobs to cheaper countries was the cause of increasing inequality, then wouldn’t people start really really complaining about it earlier since Japan was the export powerhouse before China was?

Below is a chart showing the percentage of US imports that come from Japan and China from 1987 to 2020. As you can see, Japan already constituted nearly 21% of US imports in 1987. China only reached that level in the year 2015:

Source: US Census Bureau

Okay, sure, the proportion of Chinese imports might just be as great as Japan’s was. But what if it’s the total amount of imports (minus what the US has exported) that matters? And if you look closely, the largest gap between China’s exports versus imports (red solid line vs dashed line) is larger than the largest gap between Japan’s imports and exports! Would that matter?

So below’s a graph of the US’s balance of trade deficit (imports minus exports) against Japan and China as a proportion of the US’s Gross Domestic Product overtime, and on it, superimposed with our measure of inequality:

Sources: US Census Bureau, St. Louis Fed and The Federal Reserve.

And at this point, if you’re one to draw conclusions quickly, you’d see that as the balance of trade deficit with China increased until 2007 (red solid line), inequality increased (yellow solid line trending down).

And for a more “complete” picture, below’s a graph of:

Total world balance of trade deficit as red columns (in millions of USD); and

The value as a proportion of the entire US’s Gross Domestic Product as a blue solid line.

Sources: US Census Bureau and St. Louis Fed.

And once again, if you superimpose the blue solid line with our measure of inequality, you’d get this picture that suggests some relationship (correlation at the very least) between trade deficit and inequality (at least until 2009):

Sources: US Census Bureau, St. Louis Fed and The Federal Reserve.

And if you crudely linearly regressed these two numbers together, you get an R-squared value of 0.4:

Sources: US Census Bureau, St. Louis Fed and The Federal Reserve.

So are big trade deficits to blame for more inequality? Maybe. Correlation does not imply causation. But sometimes, it’s stuff like this that gets really a lot of political attention. And either through an actual personal belief, or as an act of political preservation, a leader must be taking action, or at least seen to be doing something.

I do hope that the actual smart people in the world would eventually figure out the actual nuances in this globalisation vs voter’s welfare. Otherwise, broad-brush policies that may or may not solve the root cause would be employed.

Commerce finds a way?

Okay, cool, Buy American might very well be the new reality. How is the non-US company going to get by?

Well, for one, it could set up shop in the US. For example:

General Motors and LG Chem, the South Korean battery manufacturer, are going to jointly open a new battery plant in Tennessee;

Fuyao Glass, a Chinese glass manufacturer, has opened an automotive glass factory in Ohio. But due to the lack of profitability, the relationship between the workers and the management is tense.

BYD, a Chinese manufacturing conglomerate, is manufacturing electric busses that it claims to “exceed FTA Buy America requirements, incorporating more than 70% U.S. content”. It also claims to be the “first battery-electric bus manufacturer that has both a unionized workforce and a Community Benefits Agreement, which sets goals for hiring veterans, single parents, second-chance citizens, and others facing hurdles in obtaining manufacturing employment.”;

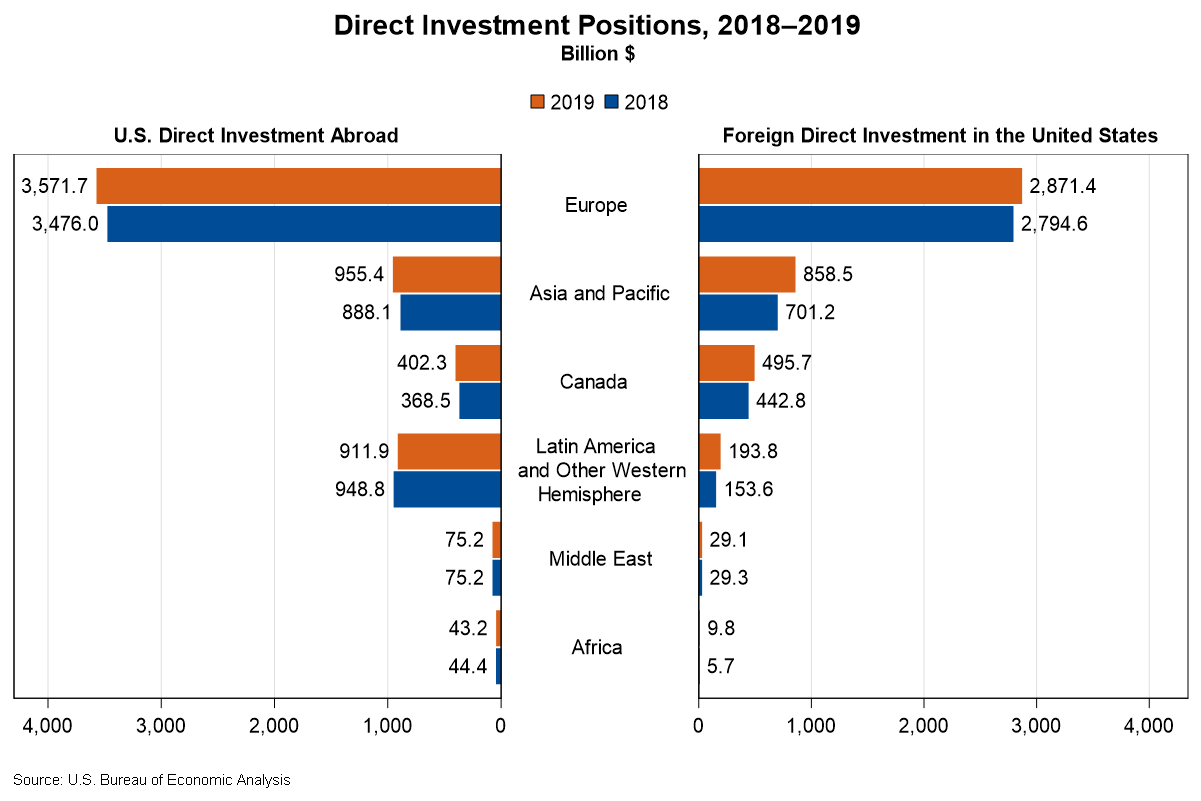

Hey, if Biden pulls it off, maybe the US would be a net recipient of foreign direct investment in the near future. I don’t know how much of that would hurt some people’s patriotic pride, but I guess overall it might be a good thing to let globalisation (via the free flow of capital into the US) work for the US’s bottom 50% again?

Source: US Bureau of Economic Analysis

What’s Japan doing nowadays (in terms of international trade)?

In the very first graph of this piece, we saw that Japan’s share of imports into the US decreased from 21% in the late 80’s to 5% in 2020. So what is Japan doing now?

Well, primarily trading with China (red solid and dashed lines):

Source: Japan Customs

And you know how last week, I discussed how some people are worried that the US central bank’s actions would lead to runaway inflation? Well, Japan has always been the odd one (or “the bleeding edge of central bank policies”, depending on your point of view).

Well, the Bank of Japan has been doing this money printing / quantitative easing thing since2001 to fight off deflation (cos, y’know, to fight off the decade-long hangover from the endless City Pop nights of the 80’s asset bubble).

The Bank of Japan is now the largest owner of Japanese stocks after it started buying Japanese stock ETFs. It also intends to keep long term interest rates low, e.g. keeping the 10-year Japanese Government Bond yields at 0% by buying as many of them. When asked in an interview about fears that the Bank of Japan might end up buying all of the Japanese Government Bonds, Kuroda, the central bank chief, said that for every percentage increase in total JGB ownership, the fewer they would have to buy subsequently to keep yields on that 0% target. In the same interview, he also explains that the purchase of Japanese stock ETFs is to directly “lower the cost of equity of Japanese companies”.

Basically, he’s all in.

Yet, he still complains that inflation is still a long way off from the 2% target rate.

So is an ageing society deflationary? That’s probably another can of worms for another day.

PS: None of my content is sponsored content. All opinions are my own. Nothing in this newsletter is investment, legal, business, medical, or life advice (my subtitle is “Your daily dose of nonsense”). Don’t be believing everything a random guy on the internet says.